There is a big gap between what most customers say about sustainability and whether they actually purchase sustainable products—much less pay a premium for them. But if companies are to achieve their sustainability goals, they must drive green choices into the mainstream. This, in turn, involves creating offerings grounded in a deep understanding of customer needs and motivations, and adopting strategies to change buying patterns. Such an effort is critical. Real change will happen only when sustainable options win adoption by mainstream customers and not just by a niche subset of purchasers.

With this in mind, BCG has conducted in-depth research to understand the barriers impeding widespread customer adoption of sustainable offerings and behaviors and to discover how companies in different consumer categories can lower those barriers. We identified eight common barriers and found that these barriers and the most effective ways to overcome them can vary by industry. Although no one-size-fits-all approach will yield optimum results, a company can develop strategies to nudge customers toward more sustainable choices by closely examining its industry, region, and customer base.

The Gap Between “Say” and “Do”

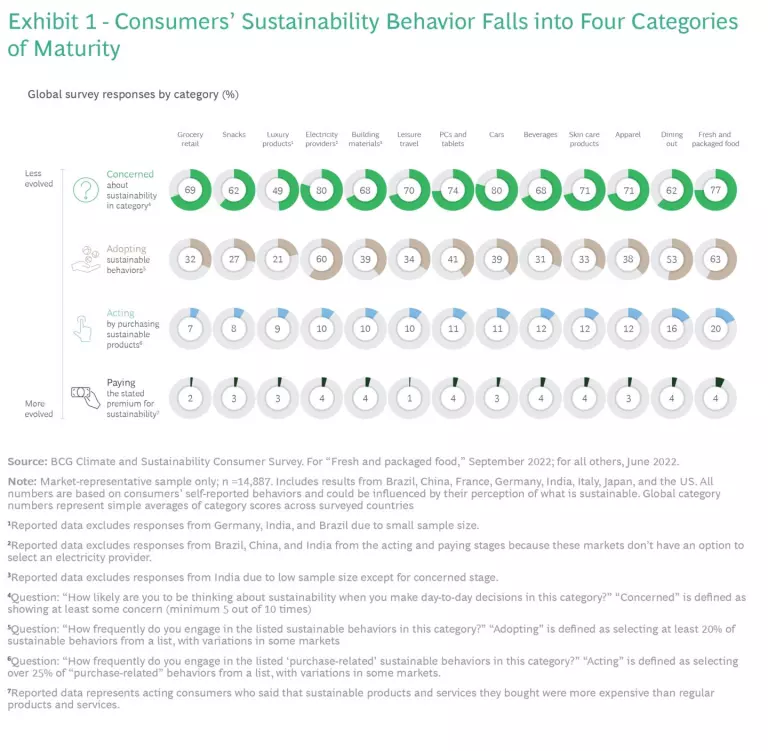

In previous research, BCG measured customer attitudes and behavior toward sustainability across four groups—concerned, adopting, acting, and paying—and found big gaps between the first group (what customers say concerns them) and the other groups (their actual buying behavior). (See the sidebar, “Methodology.”) For example, while 69% of survey respondents expressed concern about sustainability in the grocery retail category, only 7% were actually buying sustainable products. (See Exhibit 1.)

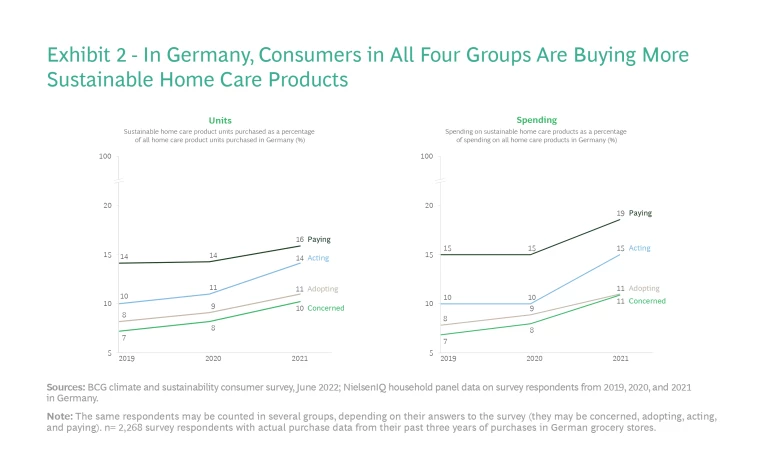

In our most recent research, we not only examined the reported behaviors and motivations of customers, but also used NielsenIQ data to analyze the actual grocery purchases of these same customers at retailers in France and Germany to establish a more definitive link between what they said and what they did. This analysis confirms that the “say-do” gap is real, as there are noticeable differences in purchasing behavior among the four groups. (See Exhibit 2.) A second finding is more encouraging: over the past three years, customers in all four groups have been steadily purchasing more sustainable products. Now companies must find ways to accelerate the trend, close the say-do gap, and drive green into the mainstream by identifying and lowering barriers to sustainable choices.

Methodology

Methodology

We assessed 13 product and service categories and subcategories:

- Consumer packaged goods (across four subcategories: beverages, snacks, fresh and packaged food, and skin care products)

- Retail (across two subcategories: grocery retail and dining out)

- Leisure travel

- Apparel

- PCs and tablets

- Luxury products

- Electricity providers (surveyed only in France, Germany, Italy, and the US)

- Cars

- Building materials

Barriers to Sustainable Choices

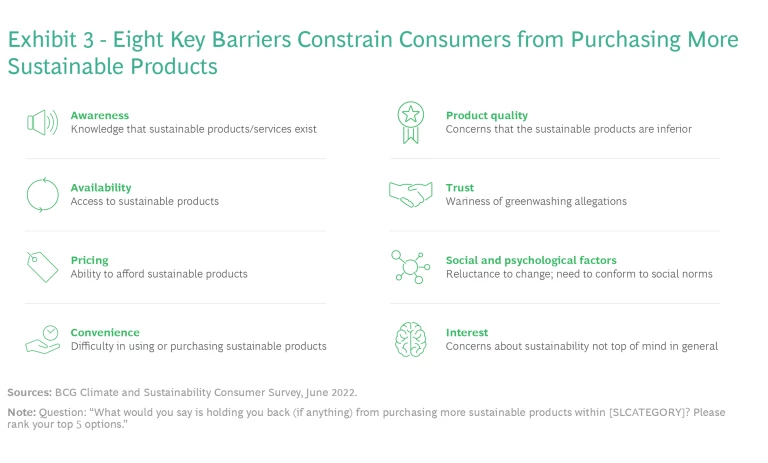

On the basis of our original global research, we have identified eight key barriers to sustainable choices that span industries and markets. (See Exhibit 3.) Overcoming these impediments requires a deep understanding of customer needs that drive choices—and the degree to which customers perceive sustainable products as delivering on these emotional and functional needs, with or without a required tradeoff.

Some barriers are quite real and demand innovative solutions. For example, there is a practical need to create sturdy drinking straws from biodegradable materials such as sugarcane to replace nonfunctional paper straws. But other barriers are grounded more in opinion than in reality, and overcoming them may require creative marketing and customer engagement techniques. For example, a company whose detergent doesn’t require hot water used NFL players in a marketing campaign to counter the perception that washing with cold water would not be effective.

Barriers by Industry

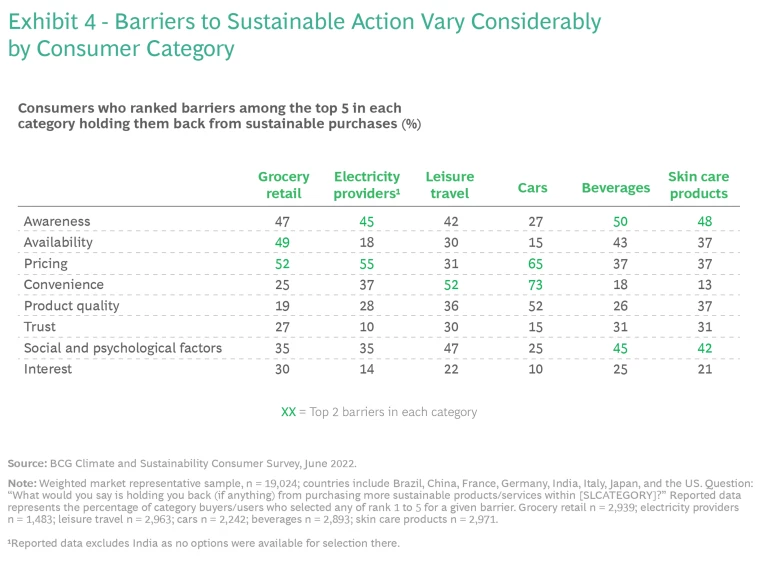

Corporate leaders also need to understand that the primary barriers to purchasing sustainable products vary by industry and market. A company must have a refined understanding of these differences if it is to determine the most effective actions and next steps to spur customer action.

For example, the issue of convenience is a major barrier in cars, some of it perceived and some real. Today the limited availability of charging stations is one key constraint on EV adoption, but another is the tendency of some customers to overestimate how far they typically drive. In contrast, awareness is a significant issue in beverages and skin care products. Many customers simply don’t know their sustainable options, a lack of knowledge that underscores the critical role of marketing and communication in educating customers. Interestingly, the social and psychological barrier—a reluctance to change deeply rooted habits and a desire to fit in and conform to social norms—poses a serious challenge across multiple categories. (See Exhibit 4.)

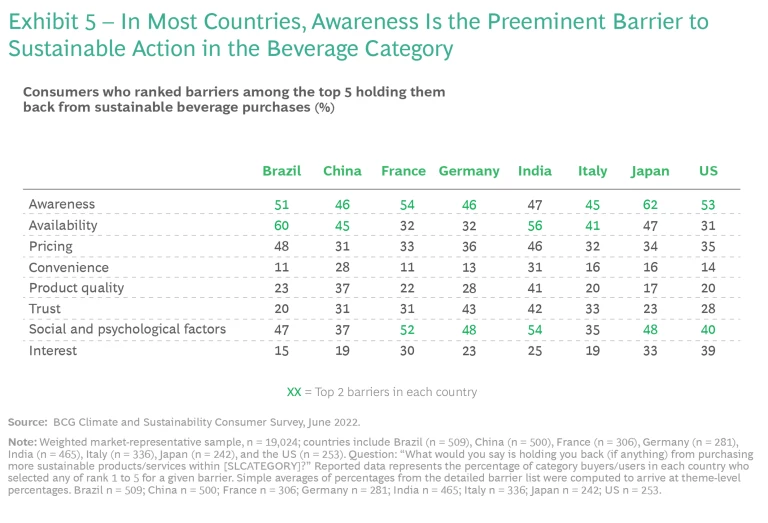

Differences by geography further complicate the calculus. In the beverage industry, as noted above, awareness is a big issue across markets. But many important differences exist between developing markets (where, for example, availability is a top-two barrier) and developed markets, (where the social psychological barrier is a top-two problem). Meanwhile, companies must also wrestle with country-specific nuances. For example, 28% of customers in China and 31% in India think that sustainable drinks are not convenient enough for them to try; to overcome this barrier, companies may need to introduce innovative packaging or reassess formats and distribution. (See Exhibit 5.)

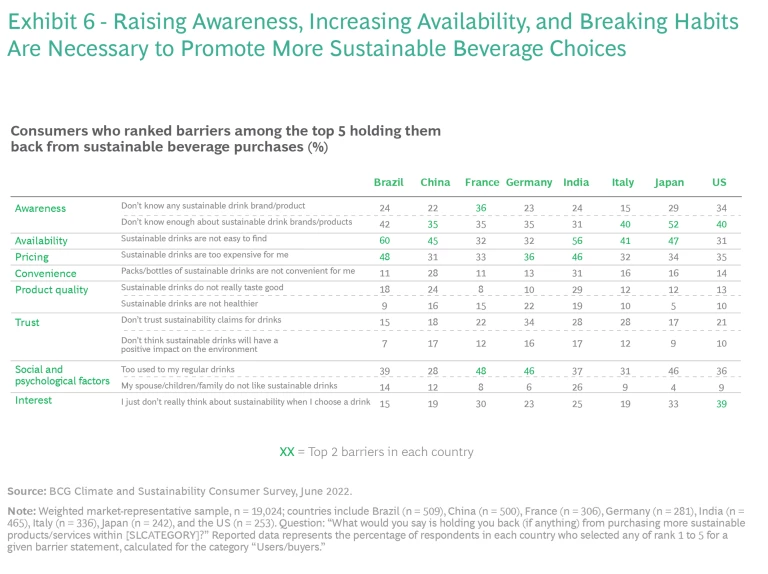

Digging even deeper into the data for beverages, we found a pervasive social and psychological barrier across countries and industries. Globally, 45% of customers said that this barrier was holding them back from sustainable choices. Clearly, old habits die hard. The kind of beer people drink while watching sporting events and the kind of coffee they drink each morning become deeply entrenched and difficult to change even when they want to do so.

Almost half of French, German, and Japanese customers admit to a psychological block—to being “too used to their regular drinks” to move to more sustainable ones. (See Exhibit 6.) The desire for social conformity is, not surprisingly, another important driver of behavior. For example, 26% of Indian customers said that a major reason for not trying sustainable drinks is that their “spouse, children or family do not like sustainable drinks.”

Behavioral Nudges to Overcome Barriers

Although overcoming engrained habits is hard and social conformity works to preserve old patterns of conduct, we have defined a four-part framework that companies can use to nudge customer behavior toward sustainable choices and attract mainstream adoption of green options. The key is to communicate how sustainable choices can meet customers’ core needs and drivers of choice (such as quality, convenience, value, taste, and health):

- Focus. Draw attention to sustainable options, and identify how they meet customers’ needs. Relevant actions might include merchandising to increase the prominence of sustainable choices and moving less-sustainable products to higher or lower shelves.

- Uplift. Use social pressure to promote sustainable choices and emphasize instances in which the sustainable choice is the mainstream choice. For example, some utilities have lowered electricity consumption among high-usage households by showing how their consumption patterns compare to their neighbors’ and by emphasizing the potential cost savings associated with lower electricity consumption. Reward and incentivize sustainable choices through simple public gestures that highlight their impact on sustainability as well as the broader win for the customer (such as by ringing a bell and tallying the total customer dollars saved).

- Simplify. Make sustainable choices the default option, such as by listing plant-based selections at the top of a menu and by not including plastic utensils with food deliveries unless asked to do so.

- Educate. Treat compliance and reporting responsibilities as an opportunity to educate customers about how the sustainable choices benefit the climate, resource conservation, and consumer needs, thereby improving awareness and building trust. For instance, follow the example of nutrition labeling (widely regarded as a successful way to educate customers about healthy and unhealthy foods) by including fact-based labels related to reduced carbon emissions and water consumption (and thus lower costs to the consumer). Position these disclosures as a competitive differentiator.

Companies should pursue behavior change experimentation as rigorously as they do new product development. For example, to test whether customers could be prompted to make more sustainable choices, B4Development, the behavioral science team of the organizing committee for the FIFA World Cup Qatar 2022, applied the four-part framework: when a customer called a restaurant to place a take-out order, the operator asked, “Do you need plastic cutlery with your order?” Here’s how the framework played out:

- Focus. Giving customers a moment to consider whether they need the utensils (without limiting their ability to say yes) encouraged sustainable decision making.

- Uplift. By declining plastic cutlery, customers enjoy making a sustainable choice, improving their self-esteem.

- Simplify. Although the intervention in this instance required an extra step, it doesn’t have to. Many popular delivery services have adopted the no plastic cutlery option as the default selection, so customers don’t have to remember to opt out. They can use their own cutlery (which they may prefer for other reasons, anyway, such as because it is sturdier and sharper), and restaurants can save on the expense of plastic cutlery.

- Educate. Customers realize the broader environmental benefit of a choice that might otherwise have seemed trivial.

Stay ahead with BCG insights on marketing and sales

The result in this case—an astonishing 59% reduction in demand for plastic cutlery—was a total win-win. The reduced use of plastic helps the environment, and the restaurant saves costs. In many cases, using reusable cutlery (for example, metal knives for cutting) is better for consumers as well; and ideally, restaurant cost savings will be passed on to consumers. A similar nudge experiment by Nudge Lebanon, a nonprofit initiative working to apply behavioral insights to policy challenges, saw demand for plastic cutlery decline even more (by 77.9%), prompting Richard Thaler, the 2017 Nobel prize winner for economics and coauthor of the book Nudge, to tweet: “great example of a low hanging fruit.”

In another case, a global supermarket in the Middle East launched an experiment with Nudge Lebanon to increase the use of reusable bags. It used a text message to remind customers to bring their eco-bags to the store, asserting that “together we can save the planet.” Here’s how the framework played out:

- Focus. The campaign attracted customers’ attention by reminding them to bring their own reusable bags.

- Uplift. By doing so, and thereby reducing plastic waste, customers feel that they are helping “save the planet.”

- Simplify. Relevant text messages are automatically sent to customers on a device that they use frequently.

- Educate. Customers realize that using their eco-bags helps reduce plastic waste.

The result was a 6-percentage-point increase in the likelihood that regular customers would bring reusable bags to the store, lowering the plastic burden on the environment and enabling the supermarket to save the cost of single-use plastic bags and to generate revenue by selling eco-bags. To move the needle beyond 6 percentage points, the company could tailor the sustainability nudge to customers, focusing on cost savings (since many governments now tax single-use plastic bags) and on the advantages of stronger, more durable eco-friendly bags.

We still have a lot of work to do to close the say-do gap and reach our collective climate ambitions. Real change cannot happen until green goes mainstream. For this to happen, companies must develop a deep understanding of customers’ needs and motivations, and then adopt strategies to change customers’ buying patterns. It’s critical to understand that encouraging more sustainable choices doesn’t require a grand marketing campaign or an enormous budget. In some instances, innovation and big changes may be necessary, but in other cases more subtle nudges can be just as effective: a well-timed text message or well-phrased question may suffice. These little nudges can go a long way to closing the say-do gap.

The authors would like to thank the following for their contributions to this article: the NielsenIQ team, the BCG survey ops team, Andrea Podobnik, Indira Zaveri, Andy Reilly, Hannah Mankin, Jiawei Liu, Aditi Batia, Supriya Shah Deo, Neeha Lingam, James Jeff, and Mohit Gupta.