After years of steady cash-to-digital migration and growing investor interest, the payments sector is entering a new phase. Payments transformation is picking up speed, and leaders now face a fragmented, high-stakes terrain where sovereignty matters, digital payments technology is rewriting the rules, and the cost of hesitation is rising fast. BCG’s 23rd annual Global Payments Report lays out the forces redefining the industry and the moves leaders must make now.

Revenue Growth Is Set to Fall by Half

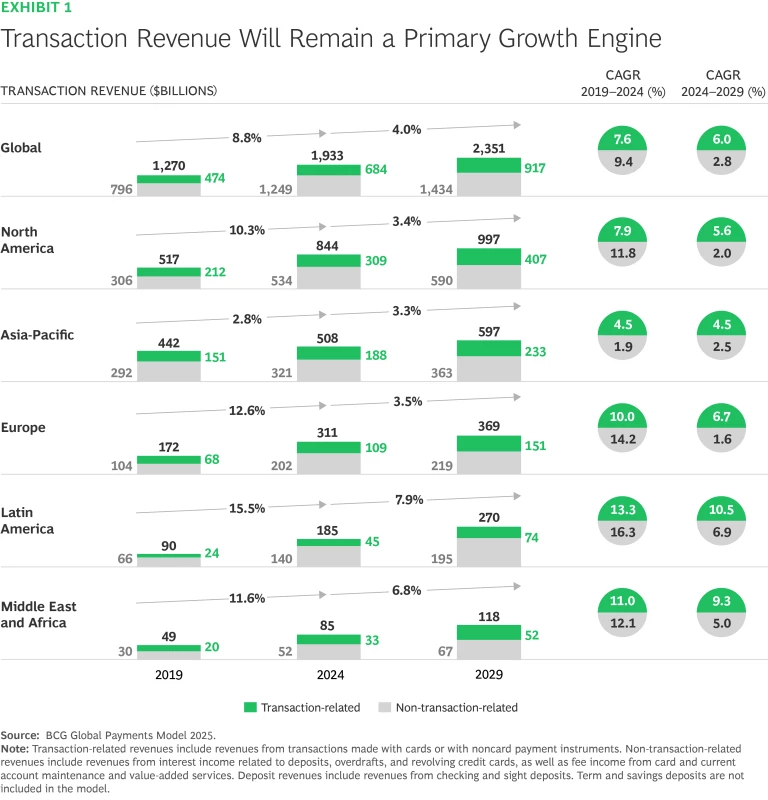

Over the next five years, annual revenue growth is expected to slow from 8.8% to 4.0% as deposit margin tailwinds fade. (See Exhibit 1.)

Transaction-related revenues will remain resilient, however. These flows should see double-digit growth in Latin America, with solid gains also expected in Eastern Europe, and nearly 9% growth in the Middle East and Africa.

Valuations Have Rebounded—But Results Vary

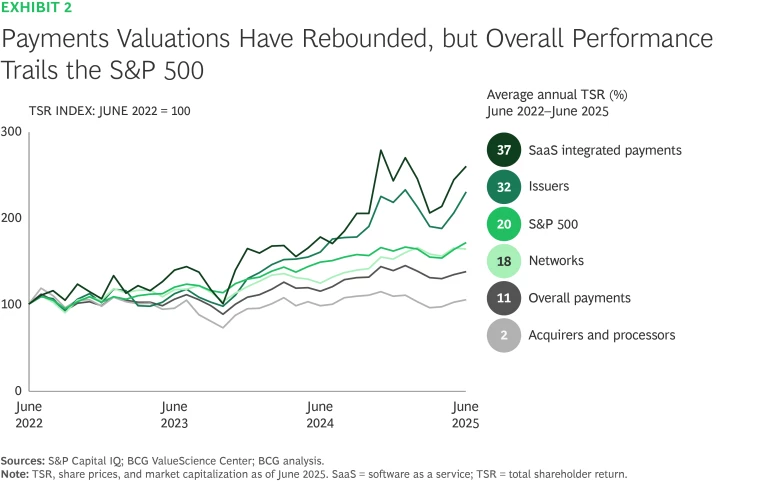

Over the past three years, payments delivered shareholder returns at about half the pace of the S&P 500. Performance varied sharply by segment, however. Players operating in the software-as-a-service (SaaS) integrated payments space led with 37% annual TSR, followed by issuers (32%) and networks (18%). Acquirers and processors lagged far behind at just 2%, as SaaS continues to encroach. (See Exhibit 2.)

Stay ahead with BCG insights on financial institutions

The rapid expansion of private credit has added a new growth lever—especially for the small to medium-size business segment and for consumer lenders looking to scale. At the same time, the abundance of private equity is enabling firms to stay private longer, while still offering capital for growth and maintaining their ability to retain and grow talent. Payments is the largest, fastest-growing, and most heavily funded part of fintech, attracting $135 billion in equity over the past 25 years—nearly a quarter of all global fintech investment. About 75% of this capital has gone to North America and Asia.

Payments Trends Converge

Trade is fragmenting, technology is leaping forward, digital assets are maturing, and compliance demands are tightening. These forces are rewriting the industry’s rules:

- Payment flows are shifting. Trade is regionalizing. Real-time and alternative payment systems are expanding. Sovereignty-focused initiatives are gaining traction, with US-denominated stablecoins providing a counterweight.

- Technology disruption is heating up. Digital payments technologies are maturing. Generative AI has reached commercial deployment, and agentic AI is embedding itself deep in the payments stack. In commerce alone, more than $1 trillion of spending could be agent-assisted, representing about 50% of total e-commerce expenditure today.

- Digital assets are gaining ground. After years of experimentation, digital money is moving into a new stage of adoption. US-denominated stablecoins have found product-market fit, supported by greater regulatory clarity. But while stablecoins globally have a market cap of about $270 billion, real-world payments still currently account for only about 1% of transaction volume.

- Operational complexity is rising. Providers face complicated sanctions regimes, real-time screening obligations, and export controls, in addition to escalating cyber threats and operational resilience mandates. Together, these pressures make risk and compliance a defining capability for competitiveness in global payments.

The Clock Is Ticking

In last year’s report, we argued for decisive moves. That imperative has only grown. Payments transformation can no longer wait. Our report highlights the key actions for banks and providers to take:

- Define a digital currency strategy. Determine how to participate in new architectures that align with the company’s strengths, its risk appetite, and applicable regulations—recognizing that issuing stablecoins is just one option.

- Prepare for agentic AI. Start testing high-impact, low-risk use cases; embed governance, compliance, and security from the outset; and modernize infrastructure and processes.

- Deploy cost excellence levers. Capture 30% to 40% savings by targeting the right moves and converting cost performance into a growth engine.

- Create a merchant services platform play. As platforms outpace incumbents in growth and retention, rethink both the value proposition and the go-to-market approach.

- Lead in real-time account-to-account payments. Scale instant payments, modernize processes, reinforce trust, build merchant-first features, expand cross-border reach, and monetize responsibly.

- Modernize risk and compliance. Reimagine compliance with adaptive, intelligence-led controls that leverage technology and respond to shifting regulation and geopolitical risk.